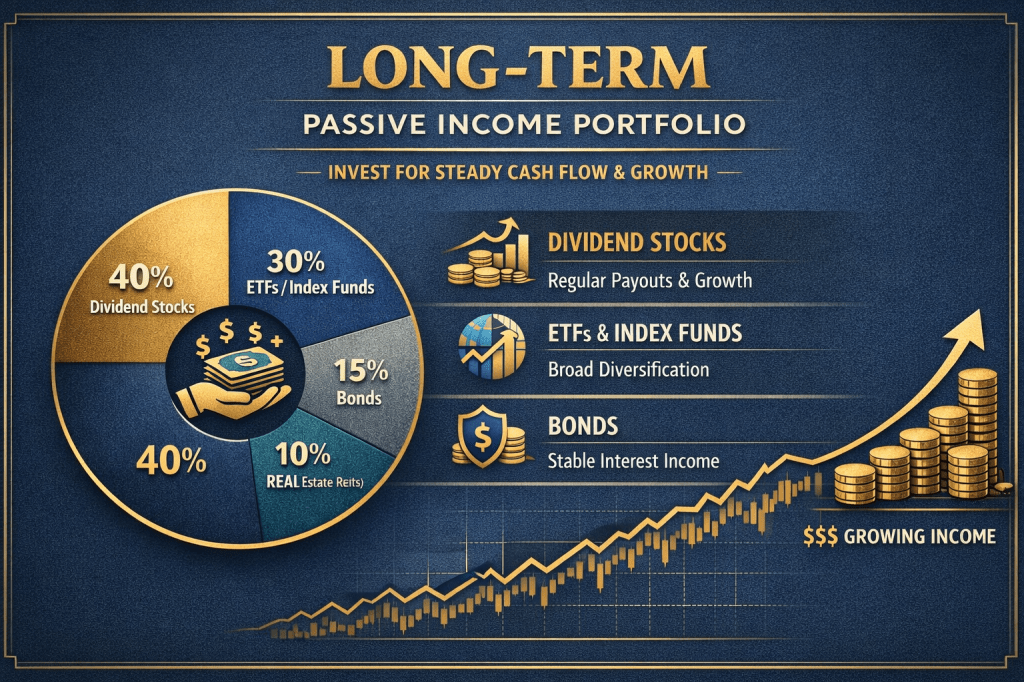

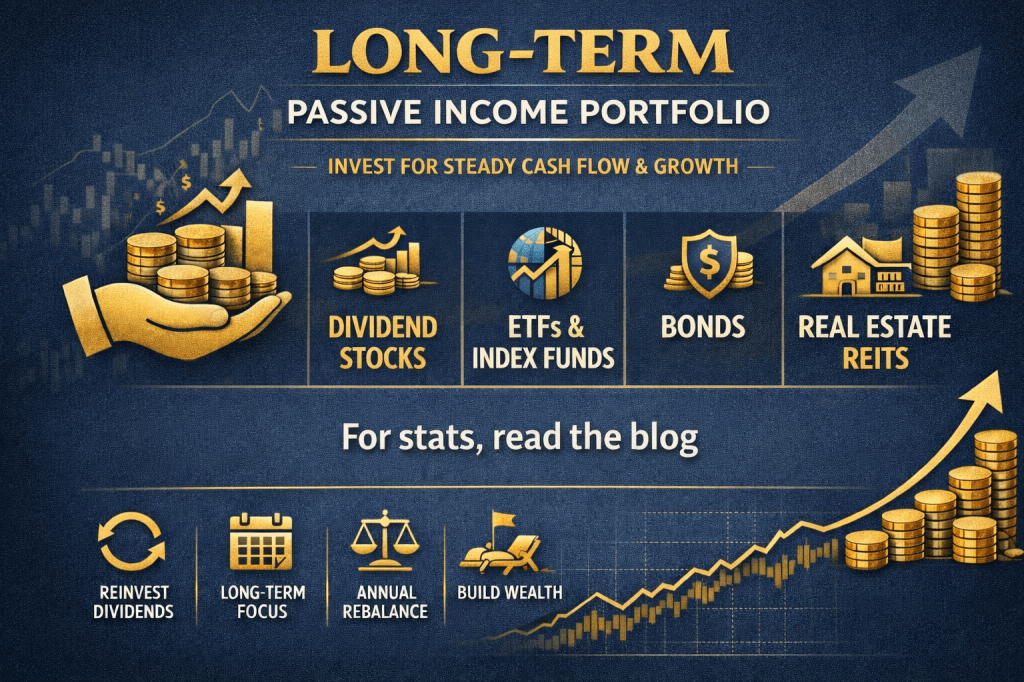

🧱 Core Assets for Passive Income

Here’s a strong, proven structure many long-term investors use:

🟢 1. Dividend Stocks (35–45%)

Pay regular cash dividends Grow income over time Examples: blue-chip, dividend aristocrats

Why? Inflation protection + rising income

🟢 2. ETFs & Index Funds (25–35%)

Broad market exposure Low fees, low effort Some ETFs focus only on dividends

Why? Stability + diversification

🟢 3. Bonds & Bond Funds (10–20%)

Government or corporate bonds Predictable interest payments

Why? Reduces volatility, steady income

🟢 4. Real Estate / REITs (10–15%)

Rental-style income without managing property Monthly or quarterly payouts

Why? Strong cash flow + diversification

🟢 5. Alternatives (5–10%)

Gold, commodities, or limited crypto Optional, small allocation

🔁 Key Rules for Long-Term Success

✔ Reinvest dividends (DRIP)

✔ Stay invested for 10–20+ years

✔ Rebalance once per year

✔ Avoid emotional trading

💡 Income Growth Example

$10,000 invested at ~6–8% average yield Reinvested for 20 years → $35k–$45k+ Income increases every year without extra effort

Want passive income that lasts? Learn how long-term portfolio investing can create reliable cash flow and financial independence over time.

Build a long-term passive income portfolio with dividends, ETFs, bonds, and real estate. Read the blog to explore the strategy in detail.

#PassiveIncome #WealthBuilding #LongTermInvesting #DividendIncome #CashFlow #FinancialFreedom #MoneyManagement #WealthMindset #IncomeStreams #MakeMoneyWorkForYou

Leave a comment