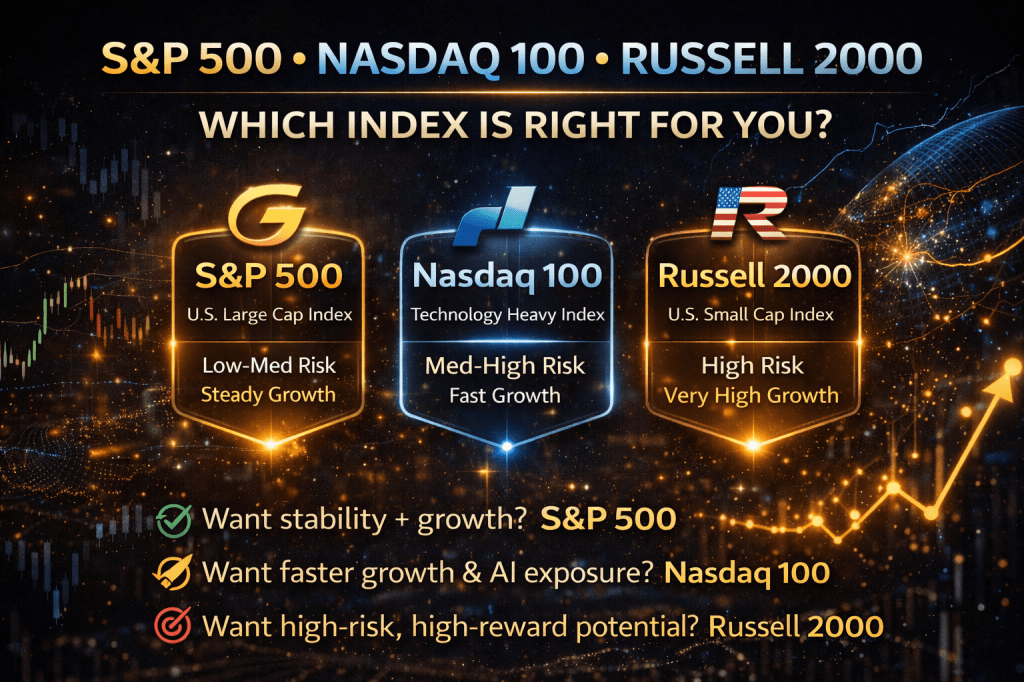

S&P 500 vs Nasdaq 100 vs Russell 2000: Which Index Should You Invest In?

Choosing the right stock market index is a key step in building a successful investment strategy. Among U.S. investors, the S&P 500, Nasdaq 100, and Russell 2000 are the most widely followed indices, each offering different levels of risk and growth potential. Sign up is free

What Is the S&P 500?

The S&P 500 index tracks 500 of the largest publicly traded U.S. companies across multiple sectors. It provides broad market exposure, steady long-term returns, and lower volatility compared to other indices. This makes it ideal for long-term investors, beginners, and retirement portfolios.

What Is the Nasdaq 100?

The Nasdaq 100 index focuses on 100 large non-financial companies, with a heavy emphasis on technology, AI, and innovation. While it offers higher growth potential, it also comes with increased volatility. This index suits growth-focused investors willing to tolerate market swings.

What Is the Russell 2000?

The Russell 2000 index represents 2,000 U.S. small-cap companies. These stocks can outperform during economic expansions but carry higher risk. It’s best for aggressive investors seeking high-risk, high-reward opportunities.

Sign up using this link & get rewards

Your choice depends on your risk tolerance, time horizon, and growth goals. Many investors diversify across all three indices to balance stability and growth.

Sign up today and get up to $1500 sign up bonus

📈 Investment & Market Hashtags

#Investing #StockMarket #LongTermInvesting #WealthBuilding

#FinancialFreedom

📊 Index-Specific Hashtags

#SP500 #Nasdaq100# Russell2000

#IndexInvesting

#ETFs

🚀 Growth & Strategy Hashtags

#GrowthInvesting

#RiskManagement

#PortfolioDiversification

#PassiveIncome

#MarketTrends

🤖 Tech & AI Exposure (Optional)

#AIInvesting

#TechStocks

#FutureOfFinance